An honest business earns profit by making other people smile.

Capital determines whether a society will be prosperous or poor, well-fed or not, populated by independent and self-reliant citizens or dependent subjects. An abundance of nutritious food, clean water, sturdy homes, safe modes of transportation, reliable sources of heat and power, modern medicines, and many other products and technologies that improve the quality of human life are impossible without capital.

A teacher can help students understand what capital is by encouraging them to think of capital as an individual’s “starter pack” for being productive and getting things done. Capital includes the tools, money, and other valuable resources a person needs to create something of value, or to solve a problem in order to create wealth.

For example, if you wanted to start a lemonade stand, the money you use to buy cups, lemons, water, and a sweetener is capital. While money is an important form of capital, capital can include other resources that help you create wealth for yourself by producing value for others.

Other Kinds of Capital:

Capital is anything you can use to “build” something that will provide experiences of value for other people. Money is the most obvious example of capital, but creativity, friendships, and even your honesty and intelligence, can be just as important, maybe even more important in some circumstances.

So, yes! Capital is cash and more: Capital includes any resource that helps you be more productive. Ask students: What kinds of capital do they have? Maybe it is their energy, ideas, or even their ability to make people laugh. Remind them that everyone—even people with little or no money—have important capital over which each person has much control: A person’s own reputation, honesty, and trustworthiness.

Evaluating incentives

One of the most important questions within any society is: Who will allocate capital? One possibility is that individuals choose whether, how, when, where, and why to spend their own money and invest their own capital. Another option is that political elites within government will tax citizens and confiscate the wealth that others have created, and then those in government will choose how to allocate other people’s their capital.

Individuals choosing how to invest their own capital have strikingly different incentives than politicians and bureaucrats in government spending other people’s money.

As we discuss in another section, profit is the happiness of other people. When individuals and business owners make their own choices about how to allocate and when to invest their own capital, they aim to earn a profit—they want a return on their investment—which is another way of saying they’re trying to make other people happy by producing value for them.

When those in government choose how to spend other people’s money, they serve their own interests, usually by expanding the scope and power of government. That is worth repeating: Business owners allocate their own capital in order to make a profit for themselves by making other people happy; government allocates other people’s capital in order to extend the power and control of government.

Every new government spending program, after all, requires expanding the class of unelected bureaucrats, adding new levels of control over what citizens may do, and adding new kinds of taxpayer-funded government competition to businesses and other private organizations.

Incentives of Allocation

For politicians and bureaucrats, resource allocation often means achieving political ends or aiming for short-term gains. Without direct knowledge of costs or profits, these decisions can be quite unpredictable.

When private individuals choose how to invest or spend their own money, they have strong incentives to make careful, strategic decisions. If they invest wisely, they personally reap the rewards; if they invest foolishly, they suffer the losses. This direct link between decisions and consequences encourages efficiency and accountability. Individuals are motivated to seek the highest return (or best use) for their funds, and they also bear the risk of losing their capital if a project fails.

By contrast, when those in government take capital from citizens through taxation, politicians and bureaucrats end up allocating resources that are not their own. As a result, several distortions can arise:

In short, when individuals allocate their own funds, they have personal incentives—financial risk and reward—to be careful stewards of their capital. When governments collect taxes and decide how to spend them, officials are allocating other people’s funds and often do so under weak or no incentives for efficiency, with less direct accountability for mistakes, and with political or bureaucratic considerations that can overshadow the goal of maximizing societal well-being.

Nº1

Nº1

Description

Download PDF Download ePub Button 3

Businesses can have multiple purposes, but the primary purpose of every business is to be profitable. When a business doesn’t earn profit, it usually closes. It makes no sense, after all, and usually becomes impossible to keep a business open when it’s losing money and not profitable.

The question we want to address here is: What exactly is profit? To which we offer an unusual answer: Profit is the pleasure of others symbolized by money.

An honest business earns profit by making other people smile.

That’s probably worth repeating: An honest business earns a profit by making other people smile. When a business brings many smiles to many faces by providing products and services that people value, appreciate, and find helpful, that business is likely to be profitable.

To be profitable simply means that (some) people value the products or services a business offers to sell more than the cash in their pockets; some people are quite willing to trade their cash for certain products. Why might that be? Let’s explore this subject by addressing some additional questions.

Why would anyone trade cash for some product or service offered by a business? And how exactly does a business make a profit from that trade?

A person is willing to trade the cash in his pocket for a business product if he values the product more than the cash. This is often the case because it would cost the person far more than the price tag on the product if he tried to make the product himself, from scratch.

A business can usually make a product far more efficiently and at much lower cost because that’s what business is: specialized labor and resources organized to make certain products or offer certain services very efficiently. A business can charge a price that’s higher than what it cost the business to make the product, but much lower than what it would cost a typical person if he tried to make the same product on his own.

When the sale price a business charges for a product is higher than the cost to make the product, the difference is profit.

When the price a customer pays for a business product is lower than the price it’d cost him to make the product on his own, the difference is the value he receives from the efficiency of the business – and that value is why a customer is willing to pay the sales price for a product, which translates into profit for the business.

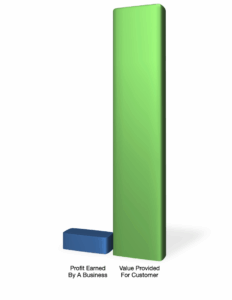

The “profit margin” for most businesses – meaning the difference between the sales price of a product versus the cost of making it – is typically quite small. Often, it costs a business almost as much to make, market, and distribute a product as the price for which the product is sold.

However, the value margin for most customers—meaning the difference between how much it costs to buy a product from a business versus how much it costs to make the product by oneself from scratch—is usually enormous. Usually it would cost a person hundreds, thousands, or even millions times more to make a product than to buy it from a business.

Imagine trying to make from scratch the ordinary devices you use every day, such as your smart phone, computer, or car. Imagine the costs in both money and time if you were to hire researchers and engineers, and try to collect all the raw and processed materials from around the world that you’d need to make any of those products.

That’s why almost always, the value for customers is much greater than any profits earned by business. Stated differently: No matter how much profit a business earns, it pales in comparison to the value that business provided for its customers. And receiving so much value from the specialized, organized productive work of people within a business is a source of great happiness. That is why the more profit a business earns, the greater the number of other people smiling with pleasure.

No documents found.